Nifty edged higher in a choppy trading session after the RBI announced reduction in SLR by 50 basis points for commercial banks after a monetary policy review, but banks did not move much, but the rally is led by metals. FII were pumping money again for third day and brought bought INR 2977.62 crs and DII Sold INR 148.81 crs

Shorterm Trend

My target of 7450 is very near and I see weakness at this range for 7300 levels. I would not initiate any trade now till we see any indication but see range of 7150 - 7500 till some time. We can only see fresh move either side only if this get breached.

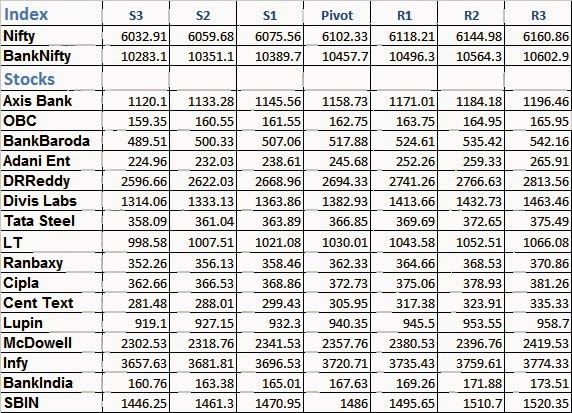

Intraday Levels

I have two plans, plan A is buy Nifty above 7436 for 7450 and 7460 and Sell below 7400 for 7395 and 7380 and Plan B is if nifty is not able to sustain above 7465 for more than 10 mins and comes below this level, I would sell for 7445 and we would buy above 7390 if Nifty moves above this level from below levels for 7415 .

Top pics for the day are Tatasteel, SSLT, AdaniPort, DLF, Crompton, BPCL, BHEL, CoalIndia,Justdial and AdaniEnt for Buy/Sell and correct levels contact vijaykumarrao.invest@gmail.com.