Nifty edged higher, with the market sentiment boosted by data showing that foreign funds remained net buyers of Indian stocks for the fourth trading session in a row and closed 6238 which is nearly 37 point up on expiry. FII Bought INR 511.15 crs and DII Sold INR 251.91 crs.

Shorterm Trend

Nifty crosse 6220 which is my second target from 6140 and has found resistance at 6240, now we below 6240 which is very strong resistance and I feel we can cross this we could 6280 and 6312 which may not be a one way move as we may see some consolidation to small correction, but market should stay above 6180 level sand below this level we we could see 6140 and 6100. This move truley based on Global cues and any reversal could reflect in our market more prominently.

Intraday Levels

As indicated by cues we could open positive and if Nifty can trade above 6260 for 10 minutes we could see 6275 and 6290 and on the lower side below 6140 for 10 minutes we could see 6225 and 6210.

Top pics for the day are CESC, Bharat Forge, Siemens, TechM, Relcap and AxisBank for Buy/Sell and correct levels contact vijaykumarrao.invest@gmail.com.

Commodity Levels

I expect bullion to be neutral, sell in Copper and sell in Crude but suggest to buy/sell in them based on levels in live market and my above outlook is only based on broader trend based on previous days data.

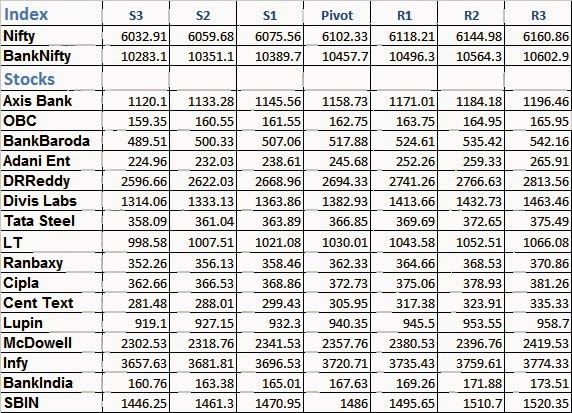

Pivot Levels

Shorterm Trend

Nifty crosse 6220 which is my second target from 6140 and has found resistance at 6240, now we below 6240 which is very strong resistance and I feel we can cross this we could 6280 and 6312 which may not be a one way move as we may see some consolidation to small correction, but market should stay above 6180 level sand below this level we we could see 6140 and 6100. This move truley based on Global cues and any reversal could reflect in our market more prominently.

Intraday Levels

As indicated by cues we could open positive and if Nifty can trade above 6260 for 10 minutes we could see 6275 and 6290 and on the lower side below 6140 for 10 minutes we could see 6225 and 6210.

Top pics for the day are CESC, Bharat Forge, Siemens, TechM, Relcap and AxisBank for Buy/Sell and correct levels contact vijaykumarrao.invest@gmail.com.

Commodity Levels

I expect bullion to be neutral, sell in Copper and sell in Crude but suggest to buy/sell in them based on levels in live market and my above outlook is only based on broader trend based on previous days data.

Pivot Levels